The headlines will tell you that we avoided

recession (a treble dip no less) but this will blur the real story. Do not be

blinded by the lights……

If ever you and / or Westminster wanted

confirmation of the state of the UK economy on the back of the austerity cuts,

the latest figures from the Office of National Statistics is a timely reminder……

Q4 2012 the economy shrunk by -0.3%.

Q1 2013 the economy grew by 0.3%.

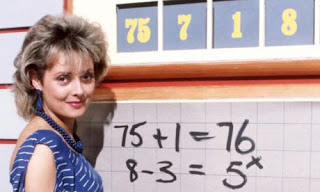

Over to Carol Vorderman for the calculation…..the

net result……0.0% growth for the past 6 months.

Remember……in the budget last month the

projection for UK economic growth is 0.6% in 2013 and 1.8% in 2014. These projections

determine income for the Government through tax revenues. If we don’t hit them,

then they must borrow more to bridge the gap in income v expenditure. Considering

our current debt level to cover this gap is £120.6 billion, how is the current

plan to reduce it to £0 going to be achieved by 2017-2018?

At risk of sounding incredibly repetitive, if

Plan A isn’t working then doing more of Plan A as a solution seems ludicrous.

So……we have avoided a treble dip recession……just!

The figures are ugly though.

Economic constipation continues……